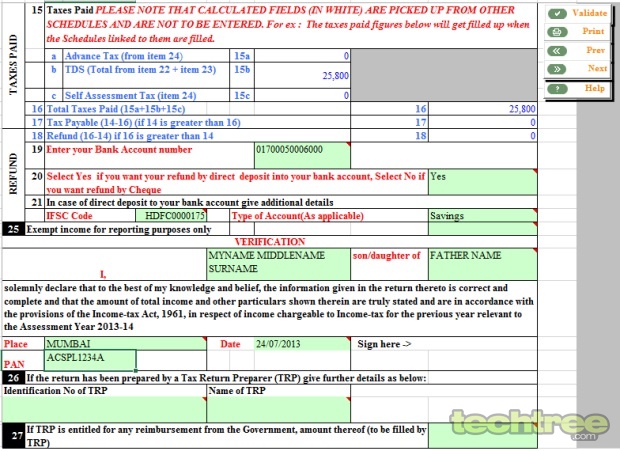

Itr V Acknowledgement 2013 14

Income Tax Return Forms. Assessment Year 2013-14. Form ITR-1:Sahaj Individual Income Tax Return AY 2013-14; Form ITR-3:For Individuals/HUFs being partners in firms and not carrying out business or profession under any proprietorship; Form ITR-2:For Individuals and HUFs not having Income from Business or Profession.

Drajver toka na tl494 video. Ako se pazljivo procitaju Macolini postovi-jasno receno da je kontroler izolovan od visokog napona. Umjesto fetova u pobudi trafoa mogli se iskoristiti po izlazu SG 3525 i puspul topologija BJT reda 1,5-2A koju neki zovu totem pole, koji takodje pogone primar pobudnog trafoa, ali ima i ona 'tim koji dobro igra ne treba mijenjati'.- pOz. Kako se fetovi otvaraju protutaktno-puspul, namece se kao najjednostavnije i najefikasnije pobudjivanje trafoom, a fetovi u pobudi su iskoristeni malo neobicno, ali efikasno daju gejtovima rednih fetova dovoljno energije za pobudu.

By on December 16, 2014 in After successful filing of your Return – you are required to send your ITR-V to CPC Bangalore. ITR-V has to be sent within 120days of your e-filing. You filed your Income Tax Return on time, but forgot to send the ITR-V? Unfortunately, unless you send your ITR-V, the department does not consider your return as filed.

Therefore, in the eyes of the Income Tax Department no return has been filed. You need to file a Fresh Return now, as if you never filed one!

The good news is you can still e-file your returns for FY 2013-14. Do remember to send your ITR-V this time!

Here’s how you can send it Also note that when you file a delayed return it has some consequences, read here to know more about it Reach out to and we will help you out!